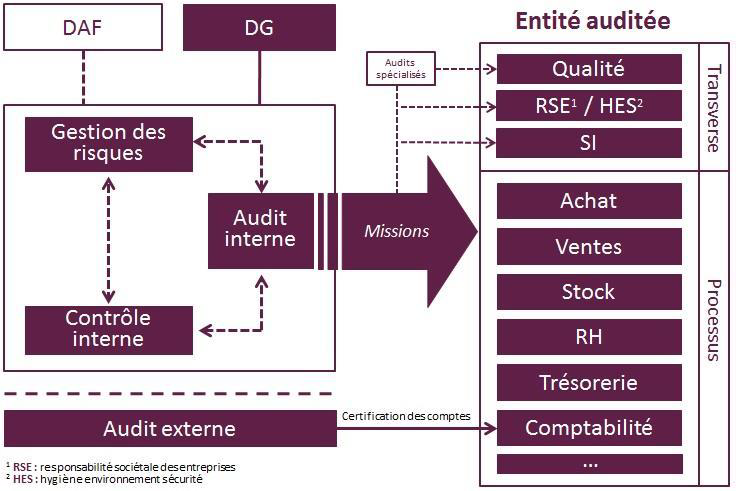

Nabyla Daidj worked in collaboration with professionals (Big Four, key accounts) as part of the ACSI Master 2 program she leads to publish two white papers in 2021 and 2023 to help her students understand how auditing works. “This is how the augmented internal audit came to my attention. It is not only a conventional accounting and financial audit, but also an audit of the information systems,” the researcher says. This type of audit can be used to assess all the activities of a company.

Internal audits examine the operating conditions for a given activity, identify risks and establish control mechanisms. “What is at stake is the evolving auditor profession,” the researcher says. Technology is redefining the limits and skills of the profession which are now associated with tools like AI (artificial intelligence).

Challenges of the evolving auditor profession due to the increased use of technology

The increased use of technology in audits pertains to two separate areas. The first is audits based on new technology. New technology is used in audits for the main purposes of improving the audit procedures (quality), automating those procedures, ensuring the reliability of the data collected and assisting decision-making. At a general level, it all contributes to more or less indirect value creation (continuous improvement of decision-making processes due to better data processing and analysis) and/or cost reduction (productivity gains, saving time) and risk reduction (including organizational risks).

All the changes introduced in terms of automation, the redeployment of employees to tasks with higher added value, improvements in quality, new services and support can help organizations increase their productivity. Yet this requires prior training all auditors as well as consideration of possible resistance to introducing new tools and practices into daily routines.

The second issue concerns the audit of new technological applications and solutions. While there is no doubt that new technology facilitates the tasks involved in internal audits, particularly IT audits, how will auditors go about auditing automation, robotization and artificial intelligence solutions? This also raises the question of the auditability of automation solutions. How can we develop new skills in this area? Will all auditors be interested in performing these new audits?

Automation tools in the augmented internal audit process

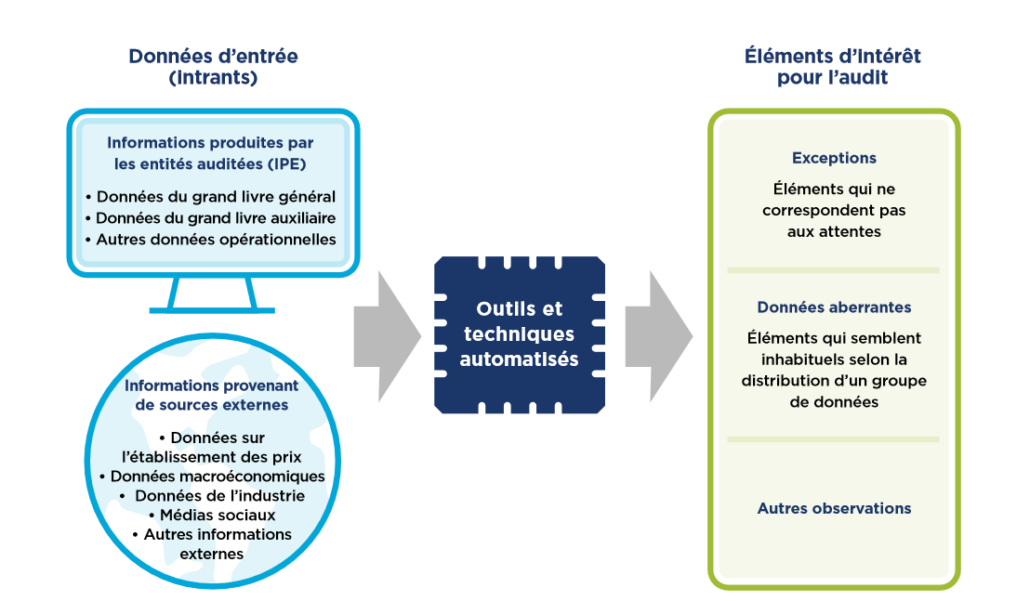

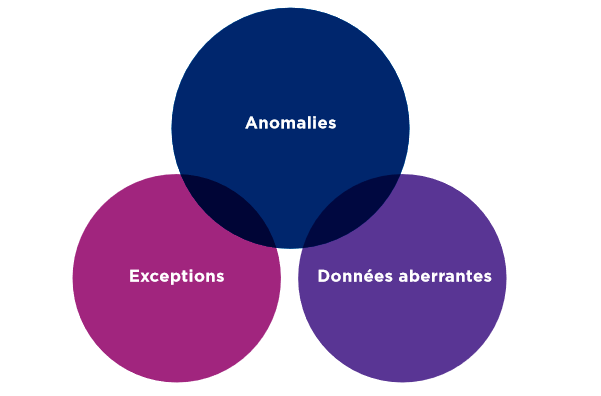

Certain tasks, especially in financial auditing, have been automated for decades. Tools like Excel were already used to select samples, run tests and document audit procedures. Certain independent software programs were also used to import datasets and select an audit task to run from the user interface, for example. But other tools emerged (RPA, AI) in the early 2010s and have continued to expand. Most major audit firms have developed their own RPA software. Auditors can now view and analyze more relevant information in addition to the more conventional documents, such as accounting records. The information comes from both audited entities and external sources.